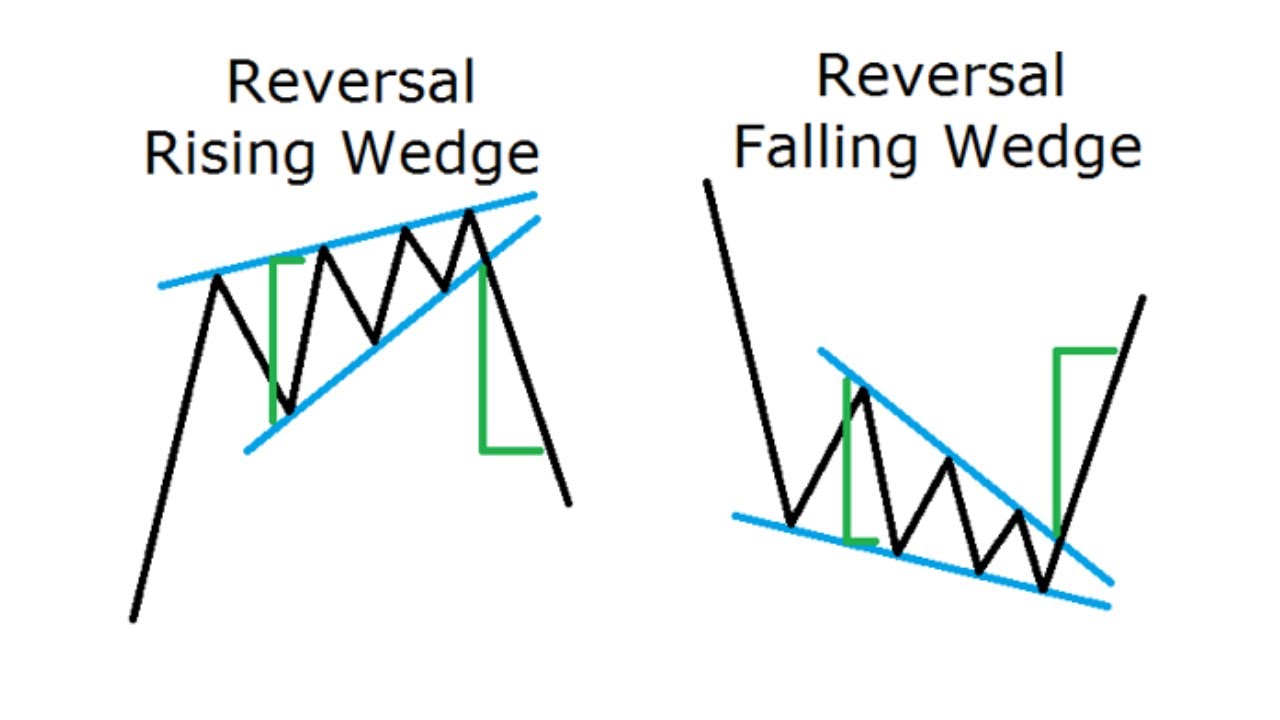

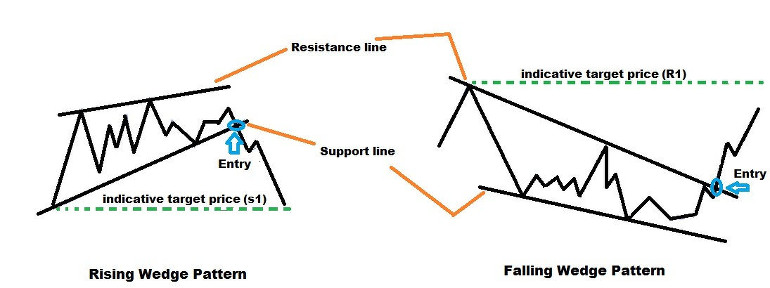

But other patterns provide clear targets for take profit levels and also provide the best stop loss scenario. There are many chart patterns that primarily detect if the next move is Bullish or Bearish. The validation of the price pattern confirms whether the trader should indeed trade in the recommended trade direction. Price action is key for the success of pattern trading. But the final component is to validate that move using price action. The success of trading patterns lies in identifying them and then using the predefined rules to ascertain the next move. But, most of the time they behave in a similar fashion. Patterns have varied levels of success in identifying the next price move. So technical analysts observe the patterns and train themselves by defining certain rules. Patterns can be found in almost every chart however, it is difficult to spot them and needs trained eyes. For best trading results traders combine the charts patterns with other indicators and decide their next moves based on the confluence. However, other technical traders consider chart patterns as an integral component of their trading system or trading strategy. So a group of technical analysts called chart pattern traders to use these patterns primarily to decide the next price move. The price behavior upon the occurrence of these patterns is almost similar and measurable. Almost all chart-based traders agree that price moves in certain patterns and they occur repeatedly in a certain fashion which can be defined using few rules. Chart traders or technical traders use chart data to analyze, understand and predict the price movements of the market. The Falling wedge also indicates the continuation of the current trend.The quest to analyze the data and predict future price movements is the core of the financial analysis. The Falling Wedge (Descending wedge) is a technical chart pattern used to identify the opportunity to earn profits in stock market.Traders use this to identify the reversal of the downtrend or continuation of the current trend.Falling Wedge Pattern appears in all time frames.The limitation for the target will be last three resistance level which was formed before by the price action. Target – There is no specific target in this pattern, most traders enjoy the profit by applying trailing stoploss. You can use trailing stoploss to maximize your profit. Stoploss – You can add the stoploss at the opening of the breakout candle. Where to put stoploss and target in Falling wedge? The price can come back for a re-test till the support level and bounces back that will be another entry point for you.

When the price action breaks the pivot high near the apex point, the closing of the breakout candle will be the entry point.

#FALLING WEDGE PATTERN HOW TO#

How to Identify the Falling Wedge pattern?įew things to remember while locating the falling wedge. It is not easy to identify, all it takes is few trend lines and consistent study of the charts to make the right opportunity for yourself to earn good profits. It indicates the reversal of the downward trend into bull run or the continuation of the current trend.

Although it is a Bullish pattern, you can notice the occurring of the pattern in both upward and downward trend. The Falling wedge Pattern is a powerful bullish pattern which occurs in technical chart. What is Falling wedge Pattern and how to do trading with it?

0 kommentar(er)

0 kommentar(er)